Flex appeal: the rising role of flexibility in the UK on the road to Clean Power 2030

Flexibility is rapidly becoming the defining lever of the UK energy transition. With recent regulatory changes now enabling behind-the-meter assets to trade in wholesale markets (P415) and removing metering requirement barriers (P483), the system is shifting from a centralised model to a distributed, responsive one. Commercial buildings, representing around 20% of UK electricity demand, remain a significant untapped opportunity. As retailers, aggregators, manufacturers and investors reposition around flexibility platforms, the key source of value is migrating from physical assets to data, orchestration, and enduring customer participation. Scaling this market will depend on clear frameworks, seamless technical integration, and user-centric models. The UK is beginning to flex: now the challenge is to build strength at speed.

Flexibility: Essential to the energy transition and a high-growth opportunity

Flexibility is essential for a decarbonised energy system, but in practice, it has been slow to scale. That is now changing. One year after the UK’s Balancing and Settlement Code modification P415 came into force, facilitating the participation of behind-the-meter resources in wholesale markets via aggregators, its impact is becoming evident. Other reforms, such as P483, which relaxes metering requirements, are removing previous barriers that limited household and small business participation and accelerating the unlocking of flexibility at scale.

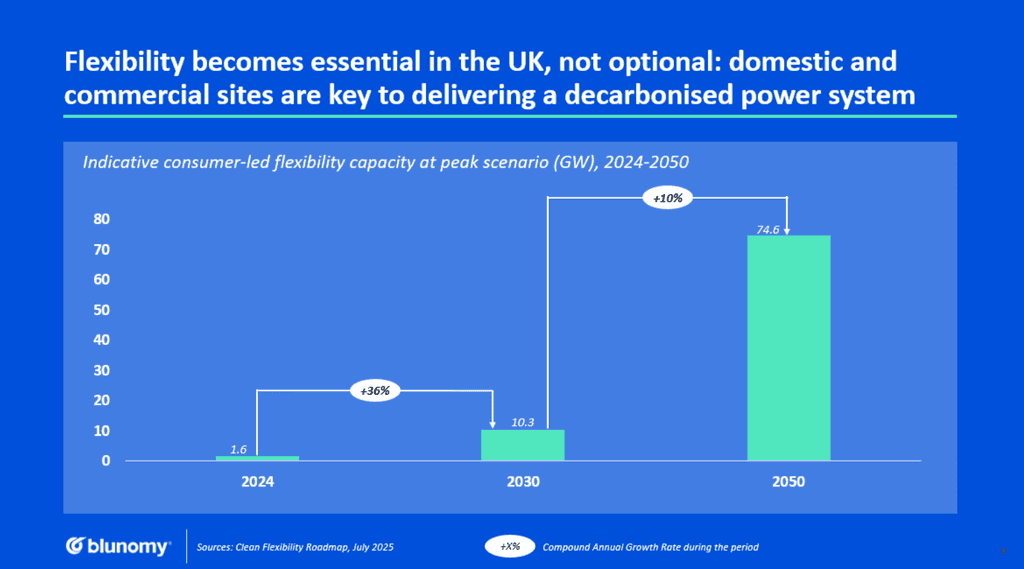

According to the Clean Flexibility Roadmap and the Smart Systems and Flexibility Plan, demand-side flexibility in the UK stood at around 1.6 GW in 2023 and needs to grow to more than 10 GW by 2030 to support the integration of variable renewable generation and unlock an estimated £6–10 billion in annual system savings by 2050. With a decarbonised power system targeted for 2035, flexibility is not optional; it is essential.

A rapidly evolving market

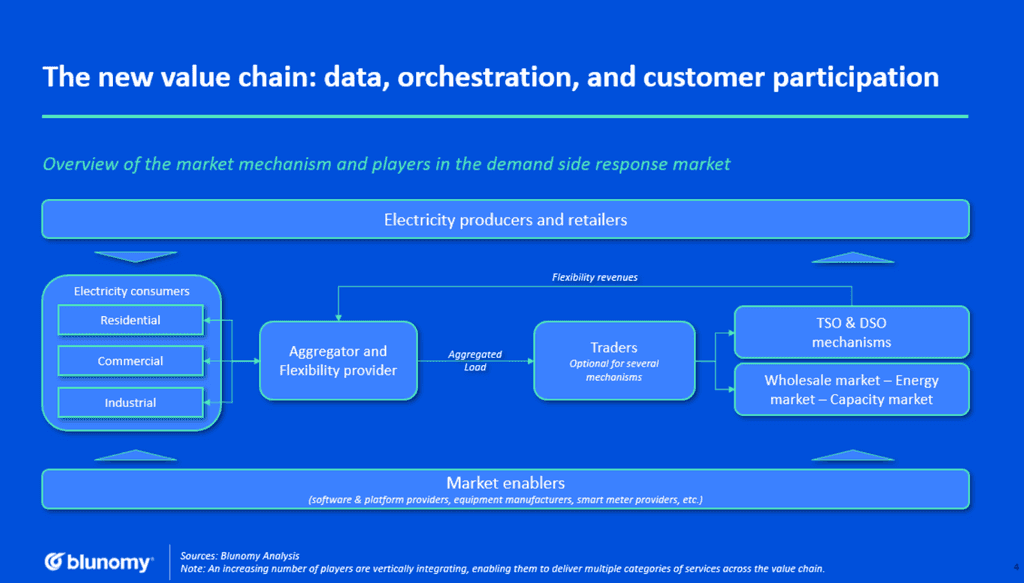

The flexibility market is entering a decisive phase, as major actors on all sides (retailers, aggregators, technology providers, manufacturers, networks, and investors) reposition to capture value in an increasingly platform-based ecosystem. Value is moving from physical assets to orchestrating data, customers, and distributed resources via scalable platforms.

- Retailers are embedding flexibility into their offers to manage wholesale exposure, enhance customer retention, and build new service-led revenues.

- Aggregators are racing to scale digital platforms that connect and monetise distributed assets, where network effects and customer reach determine competitive advantage.

- Technology providers and manufacturers are moving up the value chain, transforming hardware and data infrastructure into active flexibility assets by opening connectivity layers, offering structured access to their installed base or partnering with other retailers and aggregators.

- Network operators are opening local flexibility markets to manage grid constraints and stimulate new participation models.

- Last but not least, investors are beginning to develop dedicated strategies around flexibility, recognising its long-term value potential and moving early to back enabling technologies, platforms, and scalable commercial models.

Competition and collaboration are happening simultaneously. Value is shifting toward those who can aggregate at scale, secure customer relationships, and coordinate multiple asset types. First movers will define standards, shape customer expectations, and influence long-term market design.

The Goldilocks of flexibility

In the past, flexibility – referred to more simply as demand-side response or load shedding – was focused on larger industrial sites, achieving impactful scale with individual very large loads and being operated through a very manual process (a phone call, for instance!). More recently, aggregators have focused on domestic loads, achieving scale by signing up large numbers of small customers. This has left a gap in the middle, between the very big and the very small: commercial buildings, which account for around 20% of the UK's electricity demand, have remained largely untapped.

The main barrier for commercial participation came from regulatory hurdles, which made participation complex and financially uncertain. Reforms such as P375, P415, and P483 have addressed this, allowing behind-the-meter assets to participate in wholesale and balancing markets without altering supply agreements. The technical and operational complexity of participation has also been a barrier, with companies unable to devote significant resources to figuring out how to offer flexibility while avoiding compromise of their core business operations. Finally, the benefits of flexibility for customers have been limited in both breadth, with limited relevant markets, and visibility.

Unlocking commercial flexibility’s untapped potential

So, what will it take to truly scale commercial flexibility?

- Stable and clear market frameworks to support investment and long-term planning: the regulatory reforms already implemented provide a good base, while the maturation of new flexibility markets will help solidify additional revenue streams.

- Technical integration with assets to reduce the complexity of connecting, controlling, and orchestrating diverse behind-the-meter resources: smart metering, open APIs to facilitate communications, and improved interoperability between devices are making participation simpler and scalable.

- Customer-centric business models, where flexibility is automated, simple, and transparent: smart automation allows base-level providers to align operations with market signals, earning revenue and avoiding high prices without compromising comfort or productivity.

- Collaboration across the value chain: Aggregators, retailers, and tech providers must work together to simplify implementation, increase revenue visibility, and unlock the full potential of commercial flexibility.

The next phase of the energy transition will not be defined by new generation capacity, but by flexibility, intelligence, and coordinated operation of distributed resources. For end-users, the end result will be greater control over energy costs and carbon impact.

Where next

Where do we stand 1 year after the implementation of P415, and now with P483?

If you’re an energy retailer, a technology provider, or a flexibility aggregator, the signal is clear: now is the time to capture the flexibility opportunity.

For both commercial and domestic users, flexibility is strategic: now is the time to be considering how it can be part of your plans, transforming energy from a fixed cost into an active lever for value, sustainability, and resilience.

About Blunomy

By Simon Martyniuck (consulting manager), Paul Faraggi (Partner Energy and DER) and Safae El Fadil (Partner, UK office manager).

At Blunomy, we’re working with leading players in the energy ecosystem across retailers, aggregators, technology providers, manufacturers, utilities and investors to help them define their strategy, build capabilities, and unlock new value streams.

The flexibility revolution has begun: will you help lead it or follow? If you’d like to explore these topics further, you can reach out directly to Simon Martyniuck, Paul Faraggi and Safae El Fadili.